Dunning correctly: How to proceed legally as a creditor

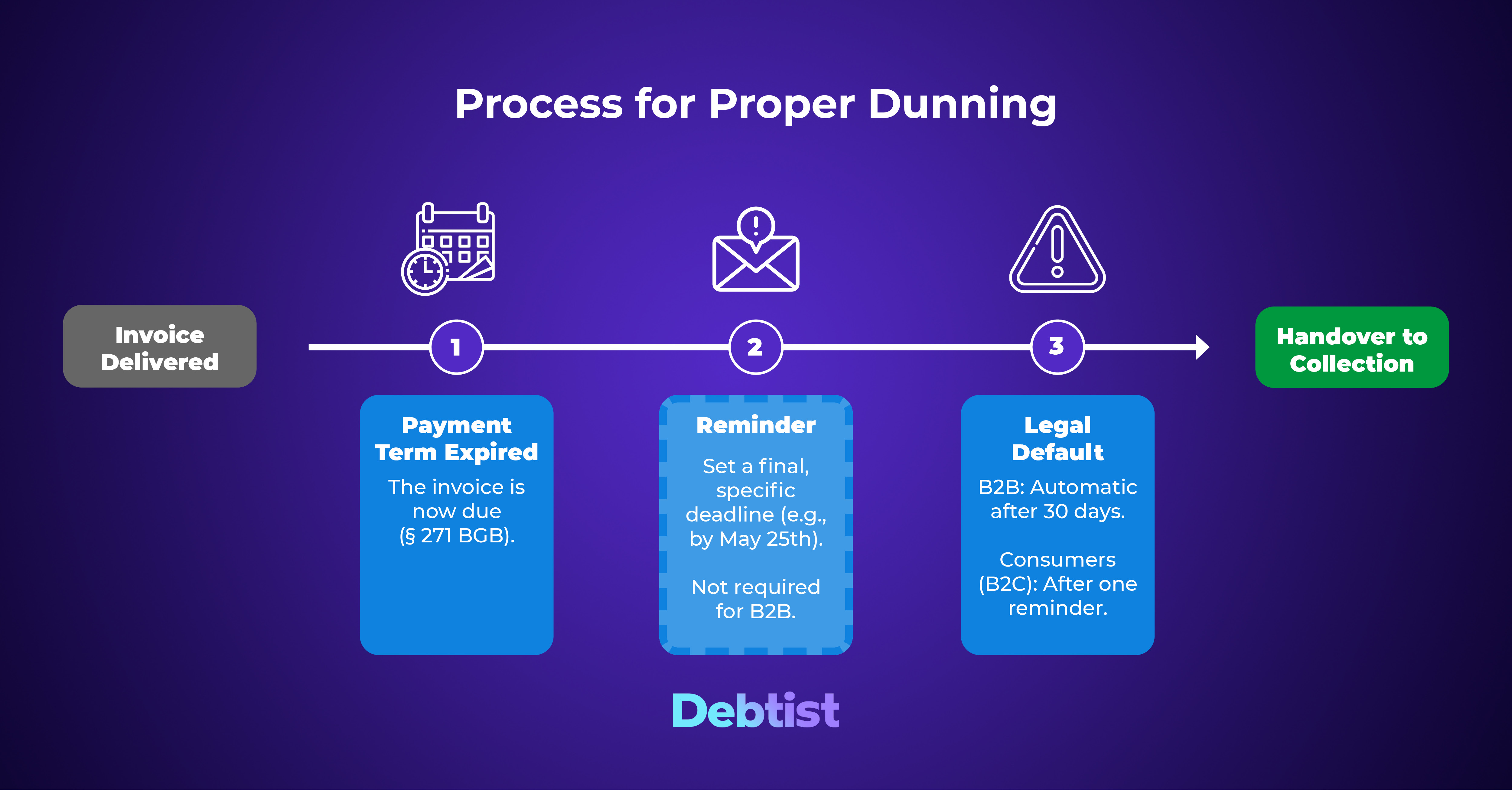

An invoice may only be reminded or handed over to a debt collection agency if it is due and unpaid.

In order for further steps to be initiated, a default in payment is mandatory (§ 286 BGB).

A reminder is not always necessary to trigger a default. That depends on whether the debtor is a business (B2B) or a consumer (B2C).

A reminder is only effective if it clearly calls for payment.

Multiple dunning levels are not legally required.

Correct dunning is the prerequisite for successful debt collection. There is often uncertainty about which form must be used and whether the deadlines are set correctly. The most common questions that arise before a claim is handed over to a collection agency are answered here.

When can open invoices be handed over to a debt collection agency?

A handover is possible, provided the claim is legally enforceable. The number of previously sent reminders is of secondary importance. For an invoice to be ready for debt collection, the following steps must have been completed:

- 1

Due date (§ 271 BGB): The original due date of the invoice (e.g., "payable by 15.05.") must have passed. If no date is agreed upon, the claim is legally due immediately.

- 2

Indisputability: The claim must not be disputed. If defects have been reported or the invoice has been disputed, a direct handover to a collection agency is generally not possible.

- 3

Default in payment (§ 286 BGB): This is the most important legal hurdle for the start of debt collection.

For companies (B2B): According to § 286 para. 3 of the German Civil Code (BGB), default automatically occurs at the latest 30 days after the due date and receipt of the invoice. A prior reminder is not legally required.

For consumers (B2C): The automatic 30-day rule only applies if on the invoice expressly was pointed out. If this notice is missing, is at least one reminder required to trigger the default according to § 286 para. 1 BGB.

What wording is required for dunning or reminders?

Legally, a reminder is not a non-binding request, but rather an unambiguous demand for performance. It decides whether the debtor is effectively put into default.

Three basic rules apply:

- 1

Clarity: Softeners are to be avoided. The debtor must understand that the time for negotiation is over.

- 2

Seriousness: The letter must state that payment is now mandatory.

- 3

Objectivity: Insults or emotional accusations seem unprofessional and do not help with enforcement.

Examples of phrasings:

To be avoided (Non-binding/Risky) | Recommended (Legally compliant/Clear) |

|---|---|

"It would be nice if you could pay soon." | "We ask you to pay the amount by [date]." |

"Please transfer in the next few days." | "Payment expected by [date] at the latest." |

"We are handing this over to our lawyer!" (if it's not true) | "After the deadline expires, we will hand the claim over to a debt collection agency." |

What data and information must be included in the reminder?

For a dunning notice to be effective, it must be unambiguously clear to the recipient which claim is involved. If mandatory information is missing, the occurrence of default can be prevented.

The following data are required:

Parties: Name and full address of the creditor and the debtor.

Reference to the claim: The invoice number and the invoice date.

Amount: The total outstanding amount (if applicable, including interest already accrued).

Prompt: A clear sentence that calls for payment.

Payment method: The bank details (IBAN/BIC) for the transfer.

Deadline: A concrete date by which the payment has to be received.

Which times and deadlines are relevant?

Deadlines create commitment and predictable processes. Two time periods are relevant:

- 1

The original payment term: This date on the invoice determines when the payment becomes due (e.g., “payable immediately” or “payable by 30.04.”).

- 2

The deadline in the reminder: A final, reasonable deadline should be set in the reminder.

Vague statements such as "in the next few days" or "promptly" are often legally difficult to grasp.

Instead is a concrete calendar date to state (e.g., “Payment receipt by [Date in 7–10 days]”). This is the only way to create a clear deadline for further measures.

Does there have to be a specific reference to the invoice?

Yes, mandatory.

The debtor must be able to immediately recognize which open item is meant. Without this reference, a reminder is often legally invalid, as the claim is not “specific” enough.

Mandatory: Invoice number and invoice date must be mentioned in the subject or text.

Optional: The original invoice does not necessarily have to be attached again. However, this can help to avoid misunderstandings if the debtor no longer has the documents or if they have been lost in the accounting department.

How are invoices handled that were not properly reminded in the past?

Often there are invoices that are due, but for which the dunning process was inconsistent (e.g. only telephone reminders or long pauses). These claims are not lost.

An inconsistent dunning history does not invalidate a claim, as long as it is not yet statute-barred (the regular limitation period according to § 195 BGB is three years to the end of the year).

The correct procedure: It is not necessary to subsequently go through several dunning levels. It is sufficient, a single, formally correct final notice to be sent with a reasonable deadline. If this deadline expires without result, the default is legally established and the claim can be immediately handed over to a debt collection agency.

Legal basis in detail

Paragraph | Significance for the dunning process |

|---|---|

§ 271 German Civil Code | Due date: Regulates when a performance (payment) can be demanded. Without an agreement, this is "immediately". |

§ 286 German Civil Code | Default: The central provision. It regulates when the debtor is in default (Para. 1 by reminder, Para. 3 automatically after 30 days) and from when damages for default can be claimed. |

§ 195 German Civil Code | Statute of limitations: The regular limitation period is three years. After this period has expired, the debtor can refuse payment. |